The winners in the sector will be those who understand the implications of automation and act quickly to respond to them.

by Steven Begley, Bryan Hancock, Tom Kilroy, and Sajal Kohli

Retail is under pressure. Margins are stressed from all sides: higher costs to manage e-commerce supply chains, growing demands from suppliers to pass on raw-material cost inflation, higher investments to match new competition, and steadily rising labor costs. At the same time, the customer’s expectations continue to surge as digital natives and disruptors alike raise the bar for personalized service—on the back of what, at times, is an advantaged cost structure. As retailers struggle to adapt, and even to survive, they increasingly pursue automation to address margin strain and more demanding customer expectations. Automation, however, is a new capability for all but digital natives, and the sophistication in approach varies accordingly.

Over the past three years, the McKinsey Global Institute has conducted a broad-based research initiative on automation across sectors. This research has shown that about half of the activities in retail can be automated using current, at-scale technology. While this number is alarming, the change will be less about job loss and more about the evolution of jobs, the creation of new ones, and reskilling. Only about 5 percent of all jobs can be fully automated with current technology, and automation will lead to the creation of jobs as companies invest in growth.

New realities

In our work in the retail sector, we see automation reshaping business models and the broader value chain. Let’s start with four new realities we observe among retailers.

1. Margin pressure has made automation a requirement, not a choice

Retail-margin pressure is mounting, driven by more intense competition, investment in e-commerce, and pressure to increase wages. While these cost pressures are not new, many retailers have already exhausted traditional cost-reduction levers.

Unable to pass on costs to their customers in this hypercompetitive environment, retailers are using automation to support and bolster margins.

These pressures are consistent across retail subsectors. Our analysis suggests that typical grocery and hypermarket retailers face 100 to 150 basis points of margin pressure, and typical specialty apparel or department stores 350 to 500 basis points. A comprehensive automation program can significantly offset these headwinds. Automation initiatives across store, supply-chain, and headquarter functions can generate 300 to 500 basis points of incremental margin, which retailers can reinvest in their growth opportunities.

2. The bottleneck to automation is internal, not external

An assessment of available automation technologies shows that they can already operate a typical retail grocery store with up to 55 to 65 percent fewer hours. The critical components include electronic shelf-edge labels, self-checkout terminals, shelf-scanning robots, and partially automated backroom unloading. These technologies have been proved at scale and offer internal rates of return higher than historical retail hurdle rates—yet few retailers are moving quickly to implementation.

In some cases, the bottleneck is a lack of skills and capabilities. But one of the biggest challenges is the inertia of the business. Retailers struggle to break free from the soft tyranny of budget cycles and the replication of last year’s capital spending. Our corporate-finance research suggests that two-thirds of companies fall into this trap. For these players, more than 90 percent of a given year’s capital expenditures simply reprise those of the preceding year. Only one-third of companies are dynamic reallocators, consistently shifting 30 to 40 percent to different business units or new uses over five to six years—that is, a reallocation rate of 5 to 6 percent a year. Dynamic reallocators enjoy disproportionate rewards: growth in total shareholder returns nearly three percentage points higher than those of other companies over an extended time period.

3. If you aren’t already implementing automation, you are falling behind Amazon

Amazon, which has made headlines with its Amazon Go retail concept, has been the most prominent disruptor. Through the implementation of automation technology, we believe that Amazon Go has the potential to deliver top-line benefits due to additional transacting traffic from reduced wait times and the use of customer insights to optimize assortments and personalize promotions. Further potential could come from the opportunity of commercializing customer data and insights. The company now operates ten Amazon Go stores, in three US cities, and the tech giant has ambitious expansion plans: 3,000 stores by 2021.

Amazon is not alone. Faced with disruption and the opportunity to expand margins, select incumbent retailers are also investing in automation and artificial-intelligence (AI) technologies at scale

to enhance both the customer and employee experience. Take, for example, Kroger Edge: digital shelves (which the retailer rolled out across 200 stores in 2018) that display prices, nutrition facts, coupons, and video advertisements—all dynamically updatable from a central source. Eventually, Kroger plans to link the shelves to shoppers’ smartphones, allowing an increased level of personalization.

Ahold Delhaize and Albertsons have announced partnerships with Takeoff Technologies, a company that builds automated miniwarehouses for the robotic in-store fulfillment of digital orders. Other retailers are exploring technology use cases for employee activities. Target and Walmart have invested in autonomous cleaning robots that save hours of its associates’ time. Walmart has also rolled out virtual-reality headsets to train associates, as well as the FAST Unloader technology to automate the backrooms of stores. If recent headlines are any indication, the adoption of these technologies by retailers will accelerate.

4. The automation opportunity is bigger than operations

Much of the discussion about the future of work in retail has focused on the use cases for automation and AI in stores. However, supply-chain and head-quarter functions (such as merchandising) will also be affected massively.

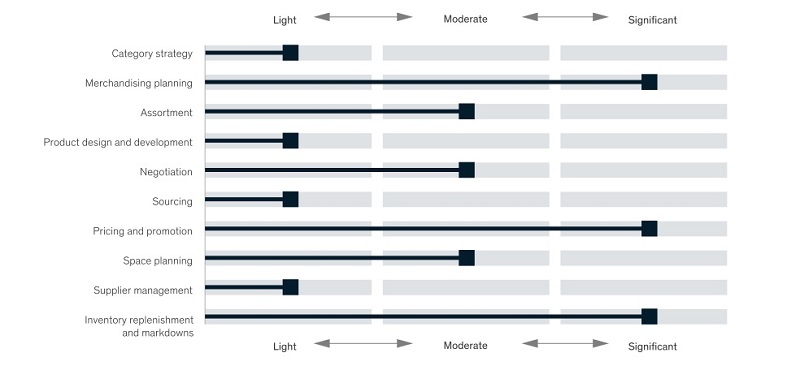

Consider merchandising. Today, automatable activi-ties account for approximately 30 to 40 percent of the time of merchants, who, for example, spend about 20 percent of their time on merchandise-planning activities. Advanced planning systems can automate historical analytics and generate predictive scenarios, significantly reducing the time needed to plan merchandise and empowering merchants to make faster decisions. Similarly, dynamic systems with web-scraping and predictive impact analytics could automate pricing and promo-tions. Automating these and other time-intensive processes will enable merchants to increase the time they spend on more strategic activities, creating value for the enterprise (Exhibit 1).

Automation can also make HR processes more efficient and provide leaders with new insights for a successful people strategy. One retailer we know, for example, designed an app-based hiring tool to streamline the recruitment of store associates. At the start of the project, the recruiting process was difficult. Each candidate would provide almost 50 documents and visit the company’s offices up to five times; end-to-end, the whole thing took an average of 45 days. To make matters worse, about 40 percent of the associates hired left within six months.

To solve these problems, the company established an agile, cross-functional working team, which created minimum viable products in just ten weeks: for candidates, a mobile-app tool to help browse

Exhibit 1

Automation will have an impact on most elements of the merchant role.

Projected impact of automation by core merchandising activity

jobs and apply for them; for HR managers, a web-based tool to screen and identify potential hires. Now implemented in more than 1,000 stores, the solution has not only reduced hiring time by more than 80 percent and store administrative hours by 20 percent but also improved the quality of new hires through the application of advanced analytics to applications.

Supply chains offer several more automation use cases, and retailers are at the forefront of implementation. Target and Walmart have partnered with Swisslog to build warehouses with automated case picking. Ocado sells its Smart Platform, a proprietary e-commerce warehousing solution, to other retailers. More broadly, automated smart robots can store, retrieve, depalletize, and transport products—all while calculating optimal routes through a warehouse. Drones and robots can also be used for security and safety surveillance and for quality checks.

Battlegrounds to survive and thrive

In this section, we explore the critical imperatives for retailers as they build the workforce of the future (see sidebar, “Is your management team actively preparing for the future of work?”).

1. Organizational structures and ways of working must be transformed

Adding technology, by itself, is not enough. Retailers must also rethink their operating models across stores, distribution centers, and headquarters. Automation creates organizations with far fewer layers—each employee is responsible for a more diverse set of responsibilities. Real-time data and analytics will empower faster decision making.

Is your management team actively preparing for the future of work?

Questions to consider:

— What is the size and scope of the workforce that would be affected by your technology road map?

— What business changes or adjacencies could generate significant new jobs?

— Do you have a plan to train people for the skills of the future? Who will be your partners?

— Given the workforce implications across the economy, would you prefer to address them proactively or reactively?

— Do you have a plan to source new talent at all levels of the company?

— How do wages need to evolve so that you retain workers and attract good talent?

Consider a store that employs shelf-scanning robots, effectively automating a large part of a traditional store-department-manager’s role. The instructions of a robot rather than a department manager guide stockers, who now work more efficiently and can therefore be cross-trained to perform additional in-store activities, such as providing service to customers or picking online orders. Meanwhile, retailers must reconsider the organizational structure, since they no longer provide a career path from stocker to department manager to store manager. Stockers must now move laterally through multiple teams while building leadership skills through outside training and executive exposure before moving on to leadership roles in stores.

To fully unlock the benefits of this technological transformation, extensive adopters of automation and AI are exploring more agile ways of working. Structurally, this means shifting from strict hierarchies and siloed functions; instead, “teams of teams” are built around end-to-end accountability, with flexible resources that improve work flow. These teams are empowered with real-time data, and decisions are purposefully decentralized to cultivate a bias to action.

2. The redeployment of labor is a strategic opportunity missed by most

Efficiency is often perceived as the primary motivator for adopting automation technologies, but among retailers, innovation is the ultimate way to survive. As they implement automation technology, they create a large bank of hours with a trained and trusted workforce. The opportunity to redeploy a portion of these hours to more valuable activities provides an opening for a differentiating kind of innovation.

Several grocers, for example, are creating new roles for in-store pickers and e-commerce distribution centers. One example of near-in redeployment is Ahold Delhaize’s e-commerce investments, which will add 150 new jobs to the local economy in Lancaster, Pennsylvania. Meanwhile, McDonald’s has not only introduced table service in restaurants but also rolled out self-service ordering kiosks. Best Buy has pushed further into adjacent services, creating new customer-service roles in its In-Home Advisor and Total Tech Support programs and retraining employees for them. In the years to come, we will see additional retailers explore shifting labor into other, further-out uses, such as home health care or installation services.

3. Retailers must prepare for skilling and reskilling at scale

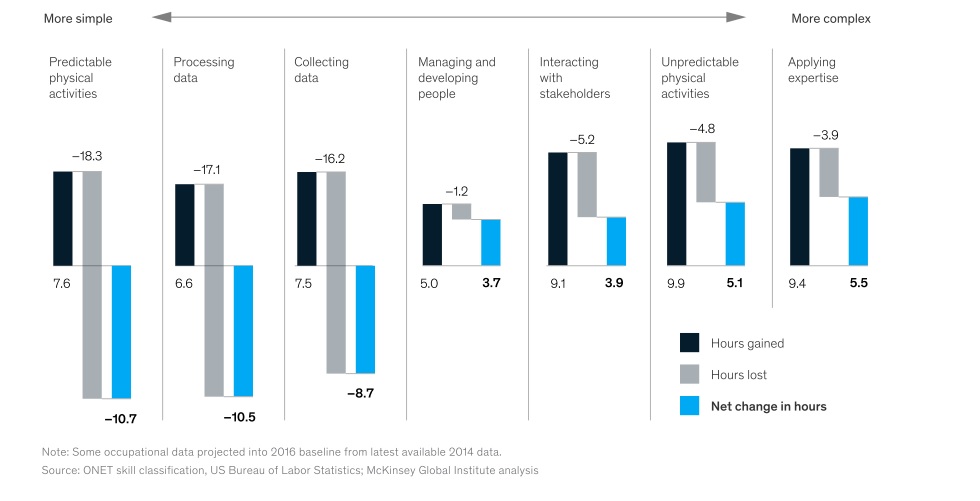

As the demand for physical and manual skills declines, the need for technological skills, as well as social and emotional ones, will rise quickly in every sector, including retail (Exhibit 2). Faced with the skill gap created by the future of work, retailers have three options to acquire talent: hire new employees, outsource to gig workers and external partners, or reskill current workers.

While hiring may appear to be an ideal solution, the rapid growth of technology companies and the digitization of incumbents have diminished the avail-able skill pool. Companies report that an inability to source talent is the main reason for delaying digital transformations, and this is hardly surprising; we estimate that digital skills are available in only half the needed quantity and agile skills in only a quarter. Retailers therefore cannot assume that hiring and outsourcing will bridge the skill gap, and this leaves a mandate to reskill employees.

Although reskilling takes a good deal of effort, it often offers a higher return on investment, in the longer term, than hiring; in fact, the business case for reskilling can be 1.5 to three times better. On average, replacing an employee can cost 20 to 30 percent of an annual salary, reskilling less than 10 percent. Reskilling existing employees also allows a retailer to retain institutional knowledge and saves the ramp-up time needed to onboard new hires. Furthermore, reskilling is more likely to earn goodwill from employees, customers, and governments alike. This goodwill can have tangible benefits; approximately 40 percent of transformations fail because of employee resistance, so a reskilling campaign can mitigate that risk. For these reasons, we believe that reskilling will be a large part of the answer for

Exhibit 2

Automation and arti cial intelligence will fundamentally reshape activities and skills.

Total change in US work hours, by activity type by 2030,1 trillion

Employers increasingly view talent—not real-estate costs—as the primary driver of decisions regarding office locations.

retailers. Across industries, global executives agree: 75 percent of those surveyed say reskilling will provide at least half of the solution for the skill gap.

Employers will play a leading role in helping workers to reskill, but collaboration with external partners will also be required. For instance, educational institutions and industry associations can create specialized curriculums and certifications for future skills. Not-for-profit organizations can develop innovative approaches to make reskilling efforts more affordable and effective. Such partner-ships are even more important for smaller retailers (such as regional grocery chains) that may have fewer resources for a substantive reskilling effort.

Companies at the forefront of employee-reskilling efforts recognize the importance of collaboration. Walmart’s Dollar a Day college-tuition program, for example, has won support from other key organizations since it started. To ensure the initiative’s success, Walmart has partnered with Guild Education, which provides coaches to help the company’s employees select the appropriate degree and navigate the college-application process. Walmart also picked its university partners thoughtfully, choosing three—Bellevue University, Brandman University, and the University of Florida— known for their high graduation rates and focus on adult learners. AT&T launched Future Ready, a $1 billion web-based, multiyear reskilling effort, with the support of universities (such as Georgia Tech) and online platforms (for instance, Coursera and Udacity).

4. Talent-acquisition strategies require an upgrade

As previously mentioned, the future of work is heightening the competition for skilled employees. Given the relative scarcity, retailers must approach talent strategy more broadly—looking, for example, at the implications for site decisions and the role of outsourcing to external partners and gig workers.

Employers increasingly view talent—not real-estate costs—as the primary driver of decisions regarding office locations, and many are moving their headquarters to optimize for talent. Ahold Delhaize’s Peapod and McDonald’s have both moved their headquarters from the outskirts of Chicago to the heart of downtown. The Canadian grocery chain Loblaws runs its Loblaws Digital organization in a trendy Toronto neighborhood rather than the main headquarters, in the suburbs. Executives from each of these companies have cited the need to attract talent as the key motivation for their site decisions.

By engaging gig workers and outsourcing tasks to partners (rather than hiring), retailers can also expand the way they define the acquisition of talent. Today, roughly one-third of US workers are freelancers; if current trends continue, independent workers could become the majority of the US workforce by 2027. Tapping into this gig economy helps employers to fill specific skill gaps quickly and more flexibly, and the opportunity to pay for outcomes can help minimize costs. Understanding these benefits, several leading companies across the full consumer ecosystem—both manufacturers and retailers—are exploring the potential of independent workers. Coca-Cola, for instance, invested early in the gig-economy platform Wonolo, which connects gig workers with potential employers. It remains a customer of the platform today, along with the North Face and Uniqlo. P&G piloted an on-demand talent initiative for project-based work, such as translations and content creation. The result was faster resourcing, improved quality, and lower costs.

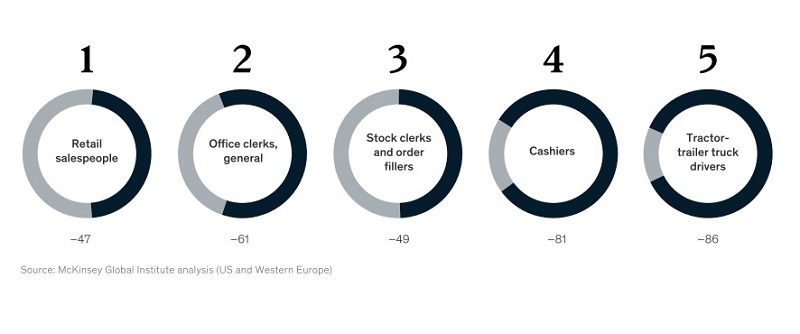

Exhibit 3

Some retail jobs will be a ected disproportionately across the United States.

Maximum potential automation impact from existing technologies, % of time with the potential to be automated

5. Wage reinvestments are a missed opportunity—few invest strategically

As retailers introduce additional automation into their retail models, they will end up with fewer but more highly skilled jobs. To get the right talent, retailers must invest in higher wages and benefits. Many retailers are managing this shift reactively, investing only when they find that they can’t attract and retain the right talent profiles. That’s a missed opportunity to take a more strategic investment approach, which can yield a higher ROI. To prepare for wage reinvestment, retailers should now develop the ability to differentiate performance and rewards for key contributors. This is also the moment to develop a clear skill-and-certification ladder that can reward employees with higher pay.

6 . Every retailer needs a social-impact plan

Automation will disproportionately disrupt retail, since three out of the five most automated jobs in any sector in the United States are in retail (Exhibit 3). By the numbers, automation will have a disproportionate impact on the entry-level roles with the lowest levels of skill—and the highest turnover. As a result, retail’s role in where “America learns to work” may shift.

The remaining retail jobs will probably be better paid, with higher skills and lower turnover. As even frontline retail jobs become more advanced, society will face a broader question: how to create better pathways so that people with entry-level skills can acquire new ones and thrive. Retailers can take a lead in answering this question—and in tailoring the solutions by types of people and communities.

The future of work has arrived in retail. Executives should prepare for the impact of automation and AI technologies across all core functions and proactively address the workforce implications. The longer companies wait to respond, the higher the risk they will not be able to catch up. Addressing automation and workforce transitions should be at the top of every retail management team’s agenda.

Steven Begley is a partner in McKinsey’s New Jersey office; Bryan Hancock is a partner in the Washington, DC, office; and Tom Kilroy and Sajal Kohli are senior partners in the Chicago office.

The authors wish to thank Nicole Chu and James Manyika for their contributions to this article.

Designed by Global Editorial Services